Week 12

Comment

Some criticize the FED, but it has lots of technical capabilities, and they have their formulas [..]

Yeah, but they don't always use their formulas

There is the so-called Taylor Rule that calculates an optimal level for the FED funds rate (the rate everyone watches like a hawk). The formula is,

which is a simple relationship between inflation, an ideal rate, and GDP. Ideal rate r is assumed to be 2.0, \pi_t is current inflation, \pi is target inflation, Gap_t is the difference between real and potential GDP. We get the data from FRED,

https://research.stlouisfed.org/fred2/

Using the following code, and some info from here;

import pandas as pd

df = pd.read_csv('taylorfred.csv', parse_dates=True,\

index_col=0,comment='#')

df = df.resample('AS');longrun = 2.0

df['GDPC1'] = df.GDPC1.interpolate(method='spline',order=1)

df['Gap'] = 100. * (df.GDPC1/df.GDPPOT-1)

df['Curr'] = df.PCEPI.pct_change()*100.

df['Taylor'] = longrun + df.Curr + 0.5*(df.Curr - longrun) + 0.5*df.Gap

df[['FEDFUNDS','Taylor']].plot()

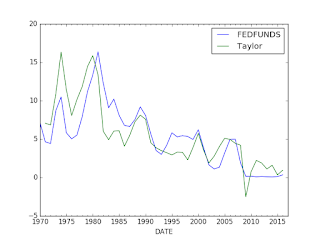

we can calculate the optimal rate. FEDFUNDS is what the FED has done instead.

The graphs are somewhat close, but they diverge at certain points. For example during the 80s (Volcker years) the FF rate was much higher than necessary. In the early 2000s, TR prescribes higher rate, but FF was much lower. Lower-than-necessary rates was one of the main causes of the subprime crisis, as everyone knows. 2009 is weird, here TR says "go negative" - and this is precisely the time when "unconventional monetary programs" were started such as QE. For 2016, formula says FF should be higher, and Yellen is desparetely trying to go there, but the market gyrations of Jan-Feb after small-ish hikes scared everyone, so they seem to have slowed down.

Wouldn't it be great to replace the FED with this 7 lines of code? Hah!

They do more than rate hikes sure, but half of what they do is fiddling with this thing- maybe they would have more time other things, I don't know, like regulation, etc. Fly-fishing, maybe?

Tech Insider

Artificial intelligence is poised to automate lots of service jobs. The White House has estimated there's an 83% chance that someone making less than $20 will eventually lose their job to a computer. That means gigs like customer service rep could soon be extinct. But it's not just low-paying positions that will get replaced. AI also could cause high earning (like top 5% of American salaries) jobs to disappear. Fast.

That's the theme of New York Times reporter Nathaniel Popper's new feature, The Robots Are Coming for Wall Street. The piece is framed around Daniel Nadler, the founder of Kensho, an analytics company that's transforming finance. By 2026, Nadler thinks somewhere between 33% and 50% of finance employees will lose their jobs to automation software [..]

More automation is a great thing

It happens to be one of the most immutable rules of business. Soft culture matters as much as hard numbers. And if your company’s culture is to mean anything, you have to hang—publicly—those in your midst who would destroy it. It’s a grim image, we know. But the fact is, creating a healthy, high-integrity organizational culture is not puppies and rainbows. And yet, for some reason, too many leaders think a company’s values can be relegated to a five-minute conversation between HR and a new employee. Or they think culture is about picking which words—do we “honor” our customers or “respect” them?—to engrave on a plaque in the lobby. What nonsense.

An organization’s culture is not about words at all. It’s about behavior—and consequences. It’s about every single individual who manages people knowing that his or her key role is that of chief values officer, with Sarbanes-Oxley-like enforcement powers to match. It’s about knowing that at every performance review, employees are evaluated for both their numbers and their values…

Right

Question

But Welch's comments above contradict another post where a CEO created metrics that defined his company's goals? [this post]

That's different

In that case the CEO created a metric that defined what was important for him; it was a way of communicating his priorities to the company. He did not impose any metrics on anyone, judge people by some cookie cutter criteria. BTW; letting people "define" their own number won't work either - employees will feel limited by them, plus in today's fast-paced work environment, agility, adaptability is more important than "school work-like" measurements - noone can know what a projects will require exactly 3 months ahead, let alone 6 months or a year. Wealthfront CEO's approach is good - he defines a hard goal (number based), but his approach is also soft; nothing is mandatory, there is no straigt-jacket, but people can slowly congregate around those aims, through osmosis, and possibly through enforcing the culture.

Republican

[Paraphrasing] We will delay, block the [new nominee Garner's] Supreme Court confirmation process [..]

Hah

And you wonder how a random jackass is wreaking havoc on your party... If you do not respect the system that you are in, approach everything from a zero-sum-game mentality, by definition you create dysfunction, then naturally end up being identified with that dysfunction. Then you can't complain someone like Donald Chump rides on a wave of distrust of the "system"; a distrust that the players themselves created.

Jürgen Schmidhuber

[answering the question 'in your eyes, what is the ideal division of work between humans and computers?'] Humans should do zero percent of the hard and boring work, computers the rest.

Yes

Question

On the Apple-vs-FBI issue which side are you on?

Apple

News

Apple’s fight with the FBI is one of the most important stories in tech today, as its outcome will have major implications for consumer privacy and safety. But while the FBI is essentially asking Apple to build a backdoor into iOS to unlock the iPhone 5c used by one of the San Bernardino shooters, other spy agencies are claiming they’re actually in favor of strong encryption.

The NSA is one of them and it has repeatedly claimed that strong encryption is required in today’s tech landscape.

Damn..

Not even NSA is on FBI's side? That is something.

Question

Can you trade futures contracts on things other than commodities?

Yes

There are futures on currencies, even stock indices.

Question

Do futures contracts always result in delivery?

No

For the commodity case, whoever ends up with the contract the last does not have to take delivery - both sides can do "cash settlement" paying each other the difference between the buyer's margin and the contract price.

Only 1% of contracts result in delivery. But that does not mean delivery does not take place elsewhere. Boeing can buy a contract on jet fuel, lock a price, then cash settle at the end, but it turns around buys the jet fuel from a local / known / familiar producer. So my conclusion is commodity contracts, their amount, their volume, are always proportional to real commodity trading going on that the contract is based on.

More of the over-the-counter banker-to-municipality non-sense, this time from Britain. The graph here says it all. Damn shame..

"LOBO.. We are writing in response to coverage of Lender Option, Borrower option (LOBO) loans sold to local authorities and housing associations – exposed by Channel 4 Dispatches and recently covered by the Evening Standard, The Independent and Financial Times (9-12 March), where banks are reported to have made up-front trading profits of £1.5 billion. [..]

A string of municipal swaps and derivatives mis-selling legal cases across Italy, France, Germany, Portugal and Belgium are testament to the fact that local authorities were not in a position to safely use complex products like derivatives, and could not be accurately described as “sophisticated” investors with full understanding of derivatives risks.

Banks pitched highly complex, opaque and risky products such as ‘inverse floaters’ and ‘range LOBOs’ which were inappropriate for the needs of local authorities. In the case of Newham council, this has had a significant adverse financial impact on its position.[..]

Unlike professional investors such as hedge funds, local authorities did not understand the inherent risks with LOBO loans, being reliant upon external treasury management advisers (TMAs) – who received undeclared income streams in the form of commissions from brokers when councils borrowed from banks"

#Noah