Less Is More

Jason Hickel

Imagine you’re an investor. You want returns of, say, 5% per year, so you decide to invest in Facebook. Remember, this is an exponential function. So if Facebook keeps churning out the same profits year after year (i.e., 0% growth), it will be able to repay your initial investment but it won’t be able to pay you any interest on it. The only way to generate enough surplus for investor returns is to generate more profit each year than the year before.

This is why when investors assess the ‘health’ of a firm, they don’t look at net profits; they look at the rate of profit – in other words, how much the firm’s profits grow each year. From the perspective of capital, profit alone doesn’t count. It is meaningless. All that counts is growth. Investors – people who hold accumulated capital – scour the globe in desperate search of anything that smells like growth. If Facebook’s growth shows signs of slowing down, they’ll pump their money into Exxon instead, or into tobacco companies, or into student loans – wherever the growth is at. This restless movement of capital puts companies under enormous pressure to do whatever they can to grow...

In the nineteenth century the global economy was worth a little more than 1 trillion dollars, in today’s money. That means each year capital needed to find new investments worth about 30 billion – a significant sum. This required a huge effort on the part of capital, including the colonial expansion that characterised the nineteenth century. Today the global economy is worth over 80 trillion, so to maintain an acceptable rate of growth capital needs to find outlets for new investments worth another 2.5 trillion dollars next year. That’s the size of the entire British economy – one of the biggest in the world...

Where can this quantity of growth possibly be found? The pressures become enormous. It’s what is driving the pharmaceutical companies behind the opioid crisis in the United States; the beef companies that are burning down the Amazon; the arms companies that lobby against gun control; the oil companies that bankroll climate denialism; and the retail firms that are invading our lives with ever-more sophisticated advertising techniques to get us to buy things we don’t actually want. These are not ‘bad apples’ – they are obeying the iron law of capital...

When we look at the impact that growthism has had on our planet since the 1980s, it makes the period of enclosure and colonisation seem quaint by comparison. All of the land and resources that colonisers appropriated across multiple continents and pulled into the juggernaut of capital – all of that has been dwarfed many times over.

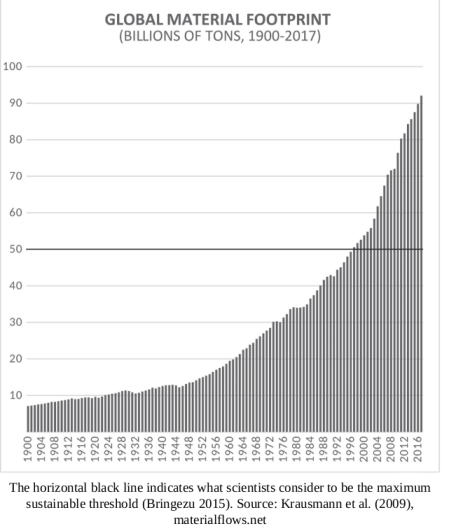

We can see this playing out in the statistics on raw material consumption. This metric tallies up the total weight of all the stuff humans extract and consume each year, including biomass, metals, minerals, fossil fuels and construction materials. These figures tell an astonishing story. They show a steady rise of material use in the first half of the 1900s, doubling from 7 billion tons per year to 14 billion tons per year.

But then, in the decades after 1945, something truly bewildering happens. As GDP growth becomes entrenched as a core political objective around the world, and as economic expansion starts to accelerate, material use explodes: it reaches 35 billion tons by 1980, hits 50 billion tons by 2000, and then screams up to an eye-watering 92 billion tons by 2017.

The graph [below] is almost breathtaking to look at. Of course, some of this increase represents important improvements in people’s access to necessary goods (in other words, use-value), particularly in poorer parts of the world; and we should celebrate that. But most of it does not. Scientists estimate that the planet can handle a total material footprint of up to about 50 billion tons per year. That’s considered to be a maximum safe boundary. Today we’re exceeding that boundary twice over...

This increase in material use tracks more or less exactly with the rise of global GDP. The two have grown together in lockstep. Every additional unit of GDP means roughly an additional unit of material extraction. There were times, such as during the 1990s, when GDP grew at a slightly faster rate than material use, prompting some to hope we were on our way to decoupling GDP from material use altogether. But those hopes have been dashed in the decades since. In fact, exactly the opposite has happened. Since 2000, the growth of material use has outpaced the growth of GDP. Instead of gradually dematerialising, the global economy has been rematerialising...

Lithium [used in batteries] is another ecological disaster. It takes 500,000 gallons of water to produce a single ton of lithium. Even at present levels of extraction this is causing real problems. In the Andes, where most of the world’s lithium is located, mining companies are burning through the water tables and leaving farmers with nothing to irrigate their crops. Many have had no choice but to abandon their land altogether. Meanwhile, chemical leaks from lithium mines have poisoned rivers from Chile to Argentina, Nevada to Tibet, killing off whole freshwater ecosystems. The lithium boom has barely started, and it’s already a catastrophe.