Economy, Calculations, Data

import impl as u

import pandas as pd

pd.set_option('display.max_columns', None)

GDP

GDP calc seen below is computed as annualized quarterly growth rate, quarter growth compared to previous quarter, annualized.

df = u.get_fred(1945,'GDPC1')

df['growann'] = ( ( (1+df.pct_change())**4 )-1.0 )*100.0

print (df['growann'].tail(5))

DATE

2024-04-01 3.589269

2024-07-01 3.340153

2024-10-01 1.852227

2025-01-01 -0.648483

2025-04-01 3.838033

Name: growann, dtype: float64

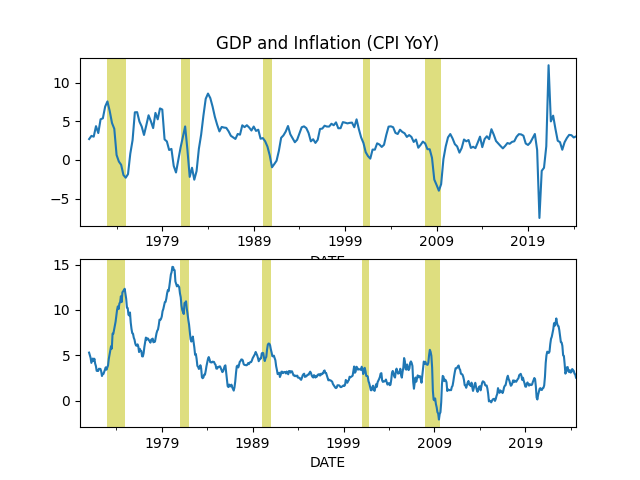

The Cycle

df = u.get_fred(1970,'GDPC1')

fig, axs = plt.subplots(2)

df['gdpyoy'] = (df.GDPC1 - df.GDPC1.shift(4)) / df.GDPC1.shift(4) * 100.0

df['gdpyoy'].plot(ax=axs[0],title="GDP and Inflation (CPI YoY)")

axs[0].axvspan('01-11-1973', '01-03-1975', color='y', alpha=0.5, lw=0)

axs[0].axvspan('01-07-1981', '01-11-1982', color='y', alpha=0.5, lw=0)

axs[0].axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

axs[0].axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

axs[0].axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

print (df[['gdpyoy']].tail(6))

df = u.get_fred(1970,'CPIAUCNS')

df['inf'] = (df.CPIAUCNS - df.CPIAUCNS.shift(12)) / df.CPIAUCNS.shift(12) * 100.0

df['inf'].plot(ax=axs[1])

axs[1].axvspan('01-11-1973', '01-03-1975', color='y', alpha=0.5, lw=0)

axs[1].axvspan('01-07-1981', '01-11-1982', color='y', alpha=0.5, lw=0)

axs[1].axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

axs[1].axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

axs[1].axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

print (df[['inf']].tail(6))

plt.savefig('cycle.png')

gdpyoy

DATE

2024-01-01 2.863294

2024-04-01 3.126632

2024-07-01 2.791390

2024-10-01 2.399788

2025-01-01 2.019273

2025-04-01 2.080467

inf

DATE

2025-03-01 2.390725

2025-04-01 2.311289

2025-05-01 2.354897

2025-06-01 2.669213

2025-07-01 2.704902

2025-08-01 2.916174

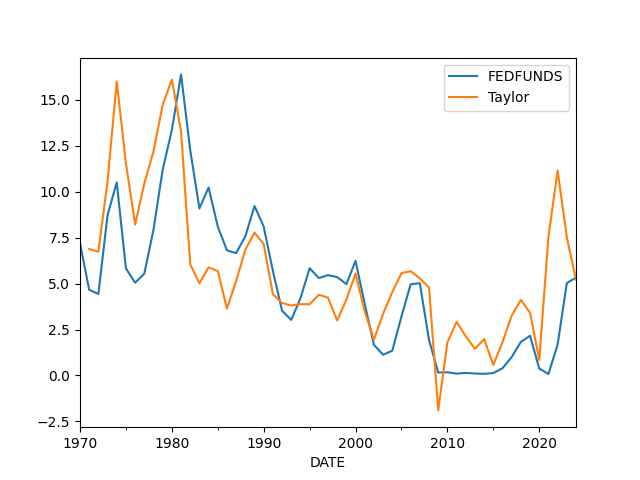

The Taylor Rule

df = u.get_fred(1970,['GDPC1','GDPPOT','PCEPI','FEDFUNDS'])

df = df.interpolate().resample('AS').mean()

longrun = 2.0

df['Gap'] = 100 * (df.GDPC1 / df.GDPPOT - 1.0)

df['Curr'] = df.PCEPI.pct_change()*100.

df['Taylor'] = (longrun + df.Curr + 0.5*(df.Curr - longrun) + 0.5*df.Gap)

print (df.Taylor.tail(4))

df[['FEDFUNDS','Taylor']].plot()

plt.savefig('taylor.jpg',quality=40)

DATE

2021-01-01 7.548193

2022-01-01 11.153139

2023-01-01 7.511558

2024-01-01 5.216667

Freq: AS-JAN, Name: Taylor, dtype: float64

Wages and Unemployment

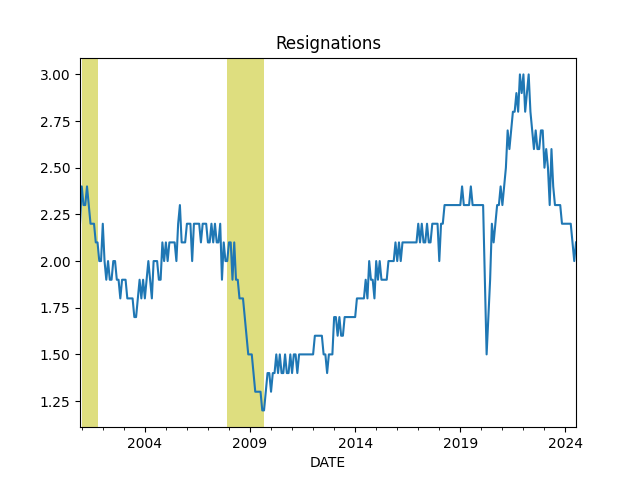

Job Quits, Resignations

df = u.get_fred(2010,['JTSQUR'])

print (df.JTSQUR.tail(5))

df.JTSQUR.plot()

plt.axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

plt.title('Resignations')

plt.savefig('quits.png')

DATE

2025-04-01 2.0

2025-05-01 2.0

2025-06-01 2.0

2025-07-01 2.0

2025-08-01 1.9

Name: JTSQUR, dtype: float64

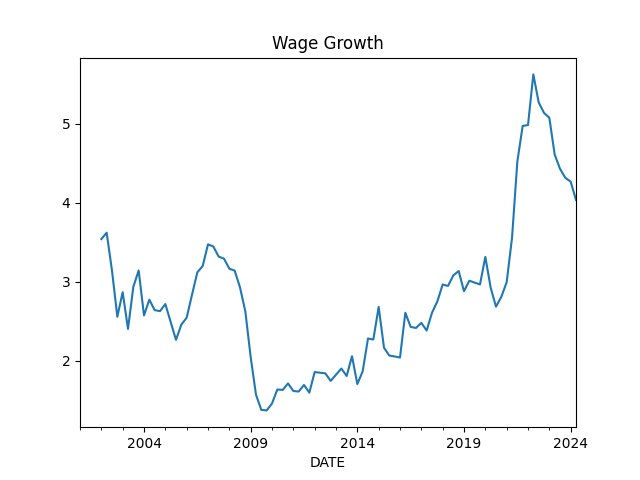

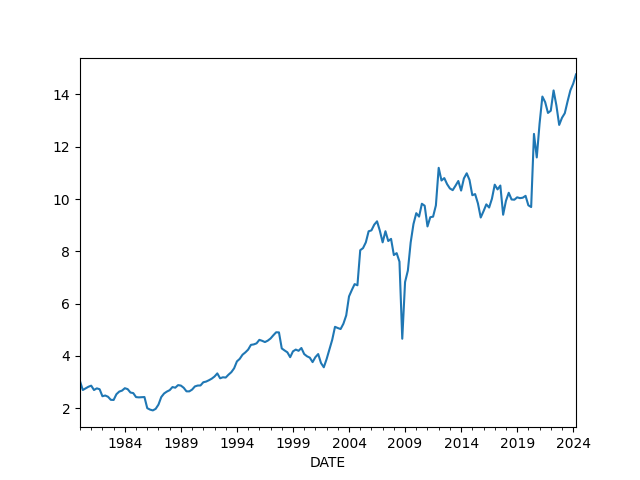

Wages

df3 = u.get_fred(1950,['ECIWAG'])

df3 = df3.dropna()

df3['ECIWAG2'] = df3.shift(4).ECIWAG

df3['wagegrowth'] = (df3.ECIWAG-df3.ECIWAG2) / df3.ECIWAG2 * 100.

print (df3['wagegrowth'].tail(4))

df3['wagegrowth'].plot(title='Wage Growth')

plt.savefig('wages.png')

DATE

2024-07-01 3.746929

2024-10-01 3.710462

2025-01-01 3.369434

2025-04-01 3.559666

Name: wagegrowth, dtype: float64

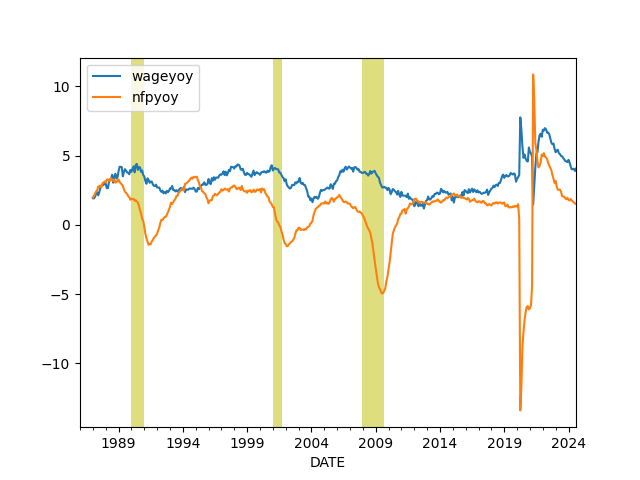

Difference Between Wage Growth YoY and Total Payrolls, see [5]

df = u.get_fred(1986,['PAYEMS','AHETPI'])

df['nfpyoy'] = (df.PAYEMS - df.PAYEMS.shift(12)) / df.PAYEMS.shift(12) * 100.0

df['wageyoy'] = (df.AHETPI - df.AHETPI.shift(12)) / df.AHETPI.shift(12) * 100.0

df[['wageyoy','nfpyoy']].plot()

plt.axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

plt.axvspan('03-01-2020', '09-01-2020', color='y', alpha=0.5, lw=0)

plt.title('Wage Growth YoY and Total Payrolls')

print (df['wageyoy'].tail(5))

print (df['nfpyoy'].tail(5))

plt.savefig('pay-wage.png')

DATE

2025-04-01 4.020101

2025-05-01 3.903904

2025-06-01 3.957433

2025-07-01 3.878025

2025-08-01 3.931285

Name: wageyoy, dtype: float64

DATE

2025-04-01 1.140610

2025-05-01 1.028968

2025-06-01 0.965076

2025-07-01 0.958843

2025-08-01 0.927414

Name: nfpyoy, dtype: float64

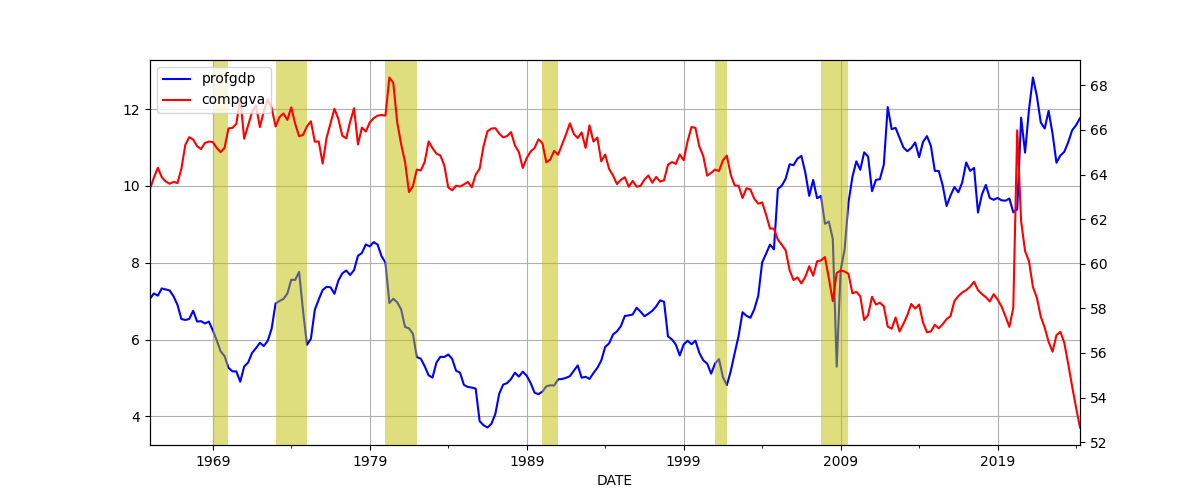

Compensation and Profits Comparison [5]

1) US Employee Compensation as a % of GVA of Domestic Corporations

2) US Corporate Profits as a % of GDP

df = u.get_fred(1965, ['A442RC1A027NBEA','A451RC1Q027SBEA','CP','GDP']).interpolate()

df['profgdp'] = (df.CP / df.GDP)*100.0

df['compgva'] = (df.A442RC1A027NBEA / df.A451RC1Q027SBEA)*100.0

u.two_plot(df, 'profgdp','compgva')

print (df[['profgdp','compgva']].tail(5))

plt.axvspan('01-12-1969', '01-11-1970', color='y', alpha=0.5, lw=0)

plt.axvspan('01-11-1973', '01-03-1975', color='y', alpha=0.5, lw=0)

plt.axvspan('01-01-1980', '01-11-1982', color='y', alpha=0.5, lw=0)

plt.axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

plt.savefig('compprof.png')

profgdp compgva

DATE

2024-01-01 11.580971 56.593605

2024-04-01 11.762248 55.894482

2024-07-01 11.584653 55.388395

2024-10-01 12.217062 54.354292

2025-01-01 12.023715 53.982527

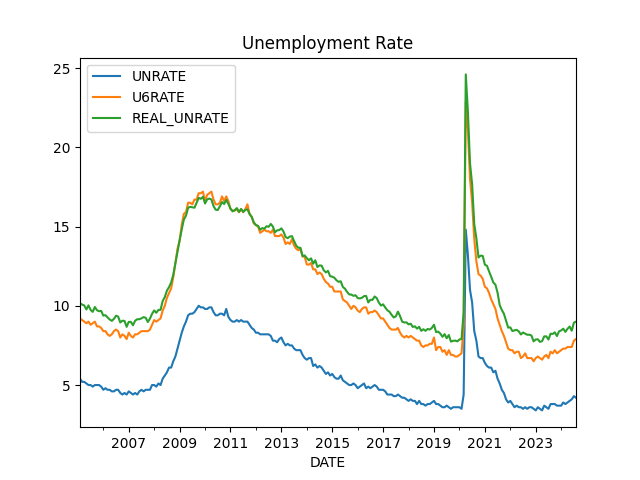

Unemployment

Calculation is based on [2]

cols = ['LNS12032194','UNEMPLOY','NILFWJN','LNS12600000','CLF16OV','UNRATE','U6RATE']

df = u.get_fred(1986,cols)

df['REAL_UNEMP_LEVEL'] = df.LNS12032194*0.5 + df.UNEMPLOY + df.NILFWJN

df['REAL_UNRATE'] = (df.REAL_UNEMP_LEVEL / df.CLF16OV) * 100.0

pd.set_option('display.max_columns', None)

df1 = df.loc[df.index > '2005-01-01']

df1[['UNRATE','U6RATE','REAL_UNRATE']].plot()

plt.title('Unemployment Rate')

print (df1[['UNRATE','U6RATE','REAL_UNRATE','REAL_UNEMP_LEVEL']].tail(5))

plt.savefig('unemploy.png')

UNRATE U6RATE REAL_UNRATE REAL_UNEMP_LEVEL

DATE

2025-02-01 4.1 8.0 9.047658 15413.5

2025-03-01 4.2 7.9 9.020406 15388.0

2025-04-01 4.2 7.8 8.871943 15183.0

2025-05-01 4.2 7.8 9.113835 15540.0

2025-06-01 4.1 7.7 8.966721 15277.5

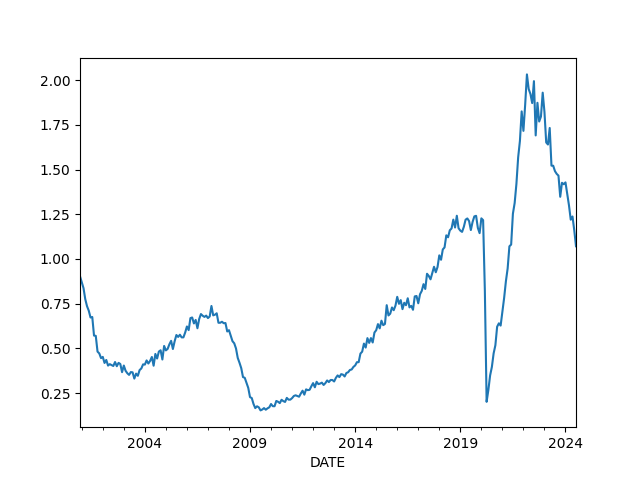

Vacancy rate, job openings divided by unemployed people

df = u.get_fred(2000, ['JTSJOL','UNEMPLOY'])

df = df.dropna()

df['VRATE'] = df.JTSJOL / df.UNEMPLOY

df.VRATE.plot()

print (df.VRATE.tail(3))

plt.savefig('vrate.png')

DATE

2025-03-01 1.016518

2025-04-01 1.031956

2025-05-01 1.073511

Freq: MS, Name: VRATE, dtype: float64

Companies

Profit Margins

Divide (1) by (2) as suggested in [4],

(1) Corporate Profits After Tax (without IVA and CCAdj) (CP)

(2) Real Final Sales of Domestic Product (FINSLC1)

df = u.get_fred(1980, ['CP','FINSLC1']); df = df.interpolate()

df = df.dropna()

df['PM'] = df['CP'] / df['FINSLC1'] * 100.0

df.PM.plot()

print (df.tail(4))

plt.savefig('profitmargin.png')

CP FINSLC1 PM

DATE

2024-04-01 3413.018 23113.092 14.766601

2024-07-01 3402.982 23302.413 14.603561

2024-10-01 3631.383 23493.422 15.457020

2025-01-01 3602.551 23311.569 15.453919

Finance

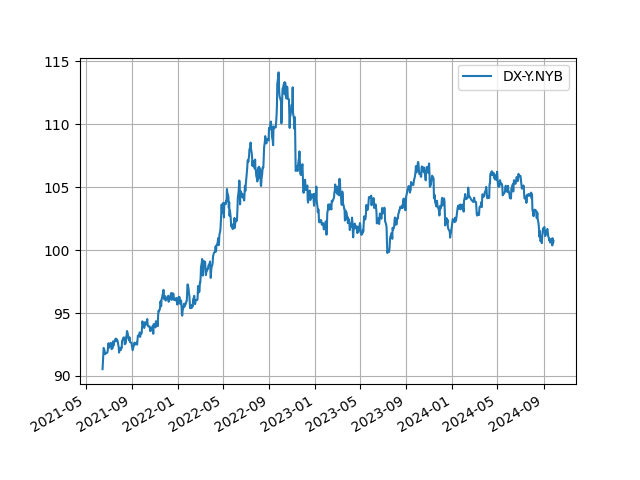

Dollar

df = u.get_yahoo_ticker2(1980, "DX-Y.NYB").interpolate()

print (df.tail(4))

m,s = df.mean(),df.std()

print (np.array([m-s,m+s]).T)

df.tail(1000).plot()

plt.grid(True)

plt.savefig('dollar.png')

DX-Y.NYB

2025-07-20 98.165001

2025-07-21 97.849998

2025-07-22 97.389999

2025-07-23 97.356003

[[ 81.72515996 111.60423874]]

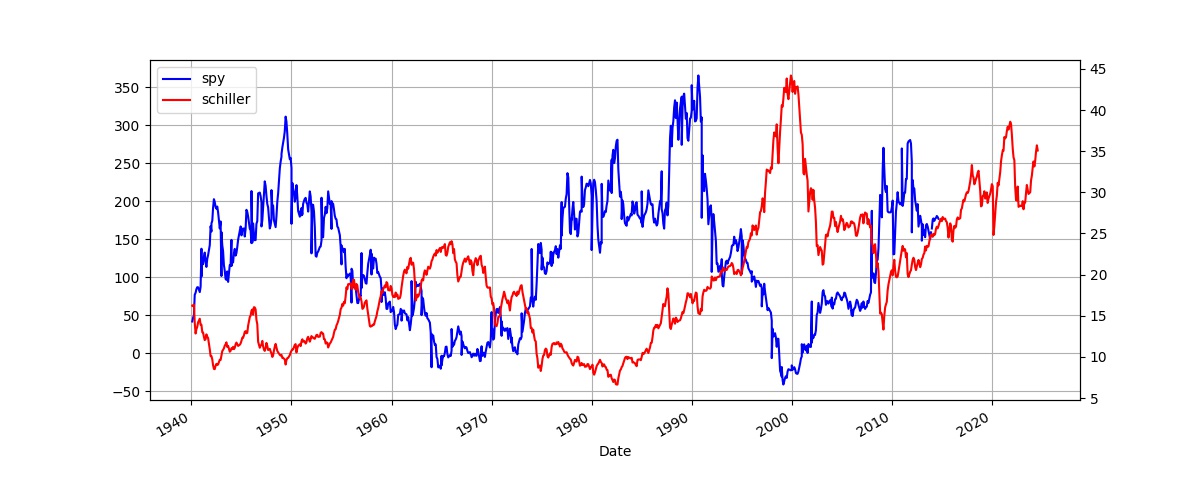

Schiller P/E

Overlay Schiller's P/E ratio on top SP 500 10-year returns [6] since 1920s. Lows and highs arrive 10 years after the market is most expensive and cheapest, respectively. The two graphs should show perfect reverse correlation.

df = pd.read_csv('../../mbl/2024/sp500.csv',index_col='Date',parse_dates=True)

df['schiller'] = pd.read_csv('../../mbl/2024/schiller.csv',index_col='Date',parse_dates=True)['Schiller']

df = df[df.index > '1940-01-01']

df['SPY10'] = df.SPY.shift(-12*10)

df['chg'] = ((df.SPY10 - df.SPY) / df.SPY)*100

u.two_plot2(df.chg, 'spy', df['schiller'], 'schiller')

plt.savefig('schiller.jpg')

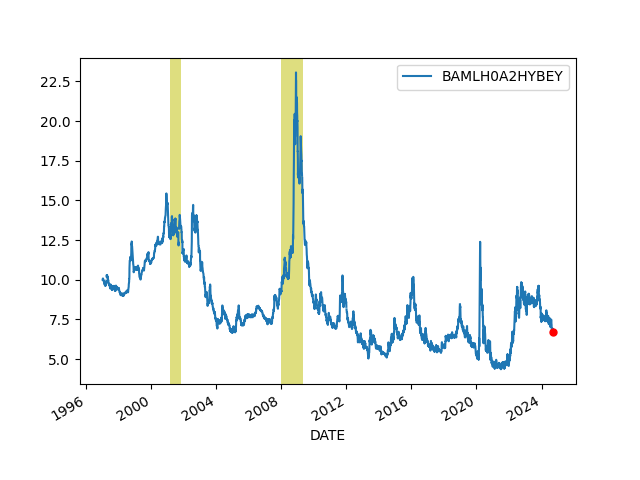

Junk Bond Yields

df = u.get_fred(1980,['BAMLH0A2HYBEY'])

print (df.tail(6))

df.plot()

plt.axvspan('2001-03-03', '2001-10-27', color='y', alpha=0.5, lw=0)

plt.axvspan('2007-12-22', '2009-05-09', color='y', alpha=0.5, lw=0)

df.BAMLH0A2HYBEY.tail(1).plot(style='r.',markersize=10)

plt.savefig('junkbond.png')

BAMLH0A2HYBEY

DATE

2025-07-15 7.08

2025-07-16 7.07

2025-07-17 6.98

2025-07-18 6.96

2025-07-21 6.87

2025-07-22 6.86

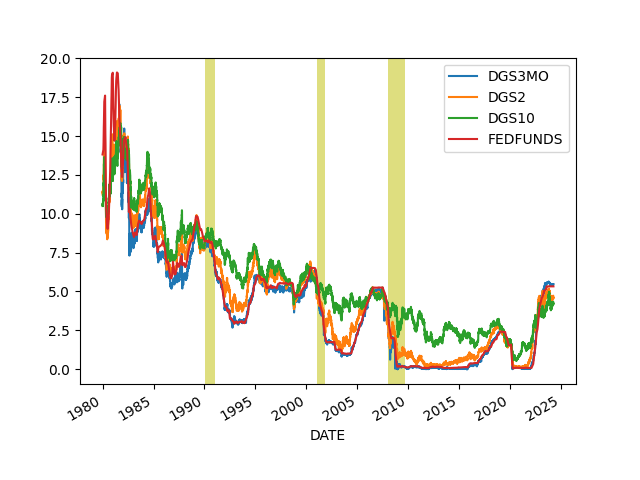

3 Month, 2 and 10 Year Treasury Rates

df = u.get_fred(2020,['DGS3MO','DGS2','DGS10','FEDFUNDS'])

df = df.interpolate()

df.plot()

#plt.axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

#plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

#plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

print (df.tail(3))

plt.savefig('treasuries.png')

DGS3MO DGS2 DGS10 FEDFUNDS

DATE

2025-07-18 4.40 3.88 4.44 4.33

2025-07-21 4.41 3.85 4.38 4.33

2025-07-22 4.41 3.83 4.35 4.33

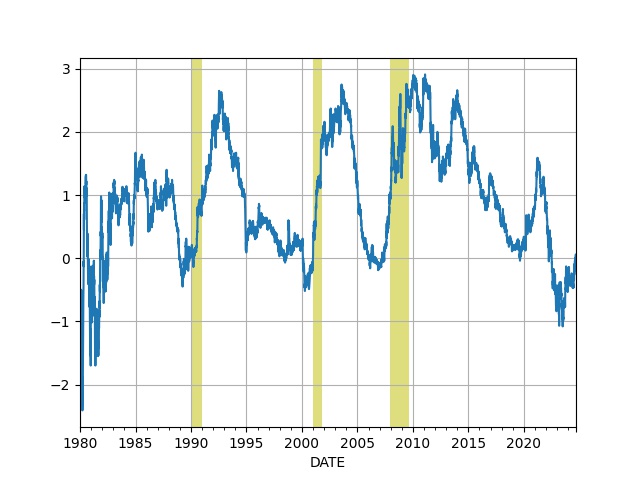

Treasury Curve

df = u.get_fred(1980,['DGS2','DGS10'])

df = df.interpolate()

df['inv'] = df.DGS10 - df.DGS2

df['inv'].plot(grid=True)

print (df['inv'].tail(4))

plt.axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

plt.savefig('tcurve.jpg')

DATE

2025-07-16 0.58

2025-07-17 0.56

2025-07-18 0.56

2025-07-21 0.53

Name: inv, dtype: float64

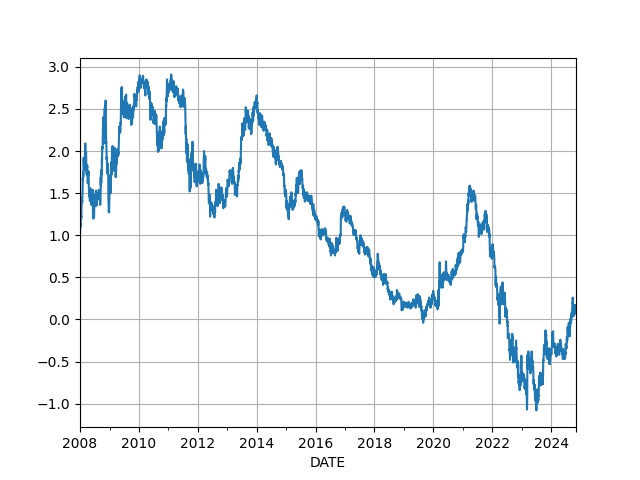

df = u.get_fred(2008,['DGS2','DGS10'])

df = df.interpolate()

df['inv'] = df.DGS10 - df.DGS2

df['inv'].plot(grid=True)

print (df.inv.tail(4))

plt.savefig('tcurve2.jpg')

DATE

2025-07-16 0.58

2025-07-17 0.56

2025-07-18 0.56

2025-07-21 0.53

Name: inv, dtype: float64

VIX

df = u.get_yahoo_ticker2(2000,"^VIX")

df.plot()

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

print (df.tail(7))

df.tail(1).plot(style='r.',markersize=10)

plt.savefig('vix.png')

^VIX

2025-07-15 17.379999

2025-07-16 17.160000

2025-07-17 16.520000

2025-07-18 16.410000

2025-07-21 16.650000

2025-07-22 16.500000

2025-07-23 15.450000

Wealth, Debt

Private Debt to GDP Ratio

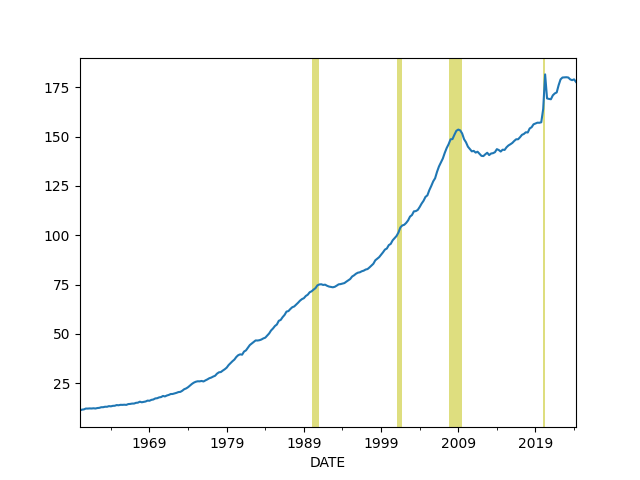

df = u.get_fred(1960,['GDPC1','QUSPAMUSDA'])

df = df.interpolate()

df['Credit to GDP'] = (df.QUSPAMUSDA / df.GDPC1)*100.0

df['Credit to GDP'].plot()

plt.axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

plt.axvspan('2020-02-01', '2020-05-01', color='y', alpha=0.5, lw=0)

plt.savefig('creditgdp.png')

print (df['Credit to GDP'].tail(4))

DATE

2024-04-01 178.778165

2024-07-01 178.824467

2024-10-01 177.332861

2025-01-01 177.556345

Freq: QS-OCT, Name: Credit to GDP, dtype: float64

Total Consumer Credit Outstanding as % of GDP

df = u.get_fred(1980,['TOTALSL','GDP'])

df = df.interpolate(method='linear')

df['debt'] = df.TOTALSL / df.GDP * 100.0

print (df.debt.tail(4))

df.debt.plot()

plt.axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

plt.axvspan('2020-02-01', '2020-05-01', color='y', alpha=0.5, lw=0)

plt.savefig('debt.png')

DATE

2024-08-01 17.326423

2024-09-01 17.336602

2024-10-01 17.395557

2024-11-01 17.370063

Freq: MS, Name: debt, dtype: float64

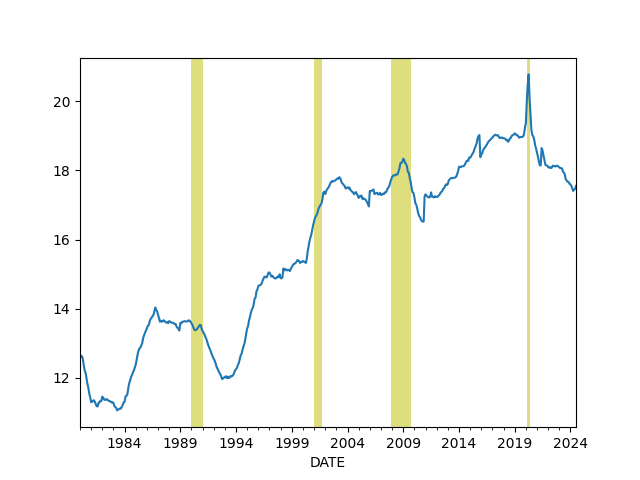

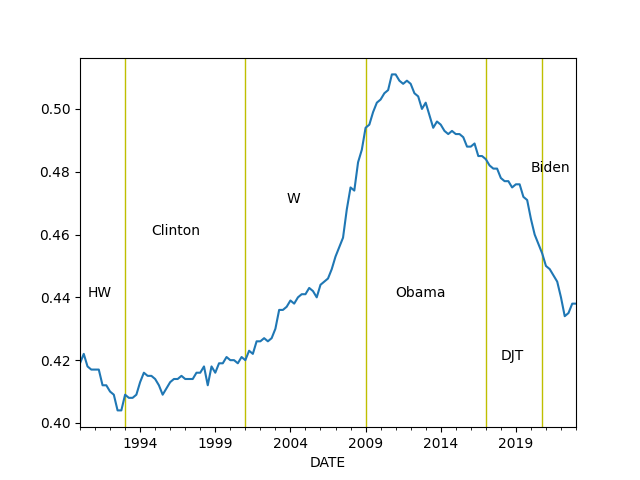

Wealth Inequality - GINI Index

Code taken from [3]

def gini(pop,val):

pop = list(pop); pop.insert(0,0.0)

val = list(val); val.insert(0,0.0)

poparg = np.array(pop)

valarg = np.array(val)

z = valarg * poparg;

ord = np.argsort(val)

poparg = poparg[ord]

z = z[ord]

poparg = np.cumsum(poparg)

z = np.cumsum(z)

relpop = poparg/poparg[-1]

relz = z/z[-1]

g = 1 - np.sum((relz[0:-1]+relz[1:]) * np.diff(relpop))

return np.round(g,3)

cols = ['WFRBLT01026', 'WFRBLN09053','WFRBLN40080','WFRBLB50107']

df = u.get_fred(1989,cols)

df = df.interpolate()

p = [0.01, 0.09, 0.40, 0.50]

g = df.apply(lambda x: gini(p,x),axis=1)

print (g.tail(4))

g.plot()

plt.xlim('1990-01-01','2023-01-01')

plt.axvspan('1993-01-01','1993-01-01',color='y')

plt.axvspan('2001-01-01','2001-01-01',color='y')

plt.axvspan('2009-01-01','2009-01-01',color='y')

plt.axvspan('2017-01-01','2017-01-01',color='y')

plt.axvspan('2021-01-01','2021-01-01',color='y')

plt.axvspan('2025-01-01','2025-01-01',color='y')

plt.text('1990-07-01',0.44,'HW')

plt.text('1994-10-01',0.46,'Clinton')

plt.text('2003-12-01',0.47,'W')

plt.text('2011-01-01',0.44,'Obama')

plt.text('2018-01-01',0.42,'DJT')

plt.text('2020-03-01',0.48,'Biden')

plt.savefig('gini.png')

DATE

2024-04-01 0.440

2024-07-01 0.442

2024-10-01 0.441

2025-01-01 0.440

dtype: float64

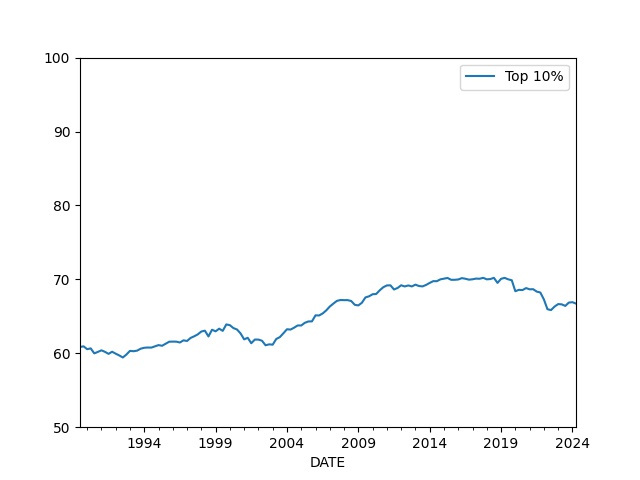

Percentage of Wealth Held by Top 10%

cols = ['WFRBLT01026', 'WFRBLN09053','WFRBLN40080','WFRBLB50107']

df = u.get_fred(1970,cols)

df = df.interpolate()

df['Total'] = df['WFRBLT01026'] + df['WFRBLN09053'] + df['WFRBLB50107'] + df['WFRBLN40080']

df['Top 10%'] = (df['WFRBLT01026'] + df['WFRBLN09053']) * 100 / df.Total

df['Bottom 50%'] = (df['WFRBLB50107'] * 100) / df.Total

print (df[['Top 10%','Bottom 50%']].tail(4))

df[['Top 10%']].plot()

plt.ylim(50,100)

plt.savefig('top10-2.jpg')

Top 10% Bottom 50%

DATE

2024-04-01 66.935229 2.463536

2024-07-01 67.378997 2.419540

2024-10-01 67.424465 2.472927

2025-01-01 67.244837 2.498183

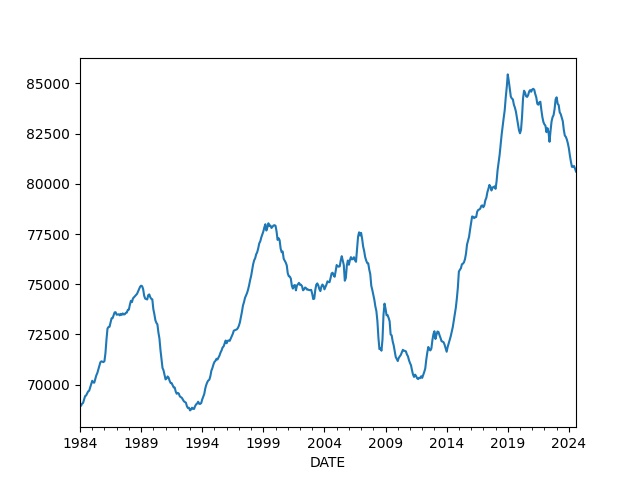

Household Income

df = u.get_fred(1980, ['MEHOINUSA646N','TDSP','CPIAUCSL'])

df = df.interpolate()

df = df.dropna()

cpi = float(df.tail(1).CPIAUCSL)

df['cpi2'] = cpi / df.CPIAUCSL

df['household income'] = df.MEHOINUSA646N * df.cpi2

df['household income'].plot()

t1 = float(df.head(1)['household income'])

t2 = float(df.tail(1)['household income'])

print ("Perc change since the 80s = %0.2f" % ((t2-t1) / t2 * 100))

plt.savefig('household.jpg')

Perc change since the 80s = 13.80

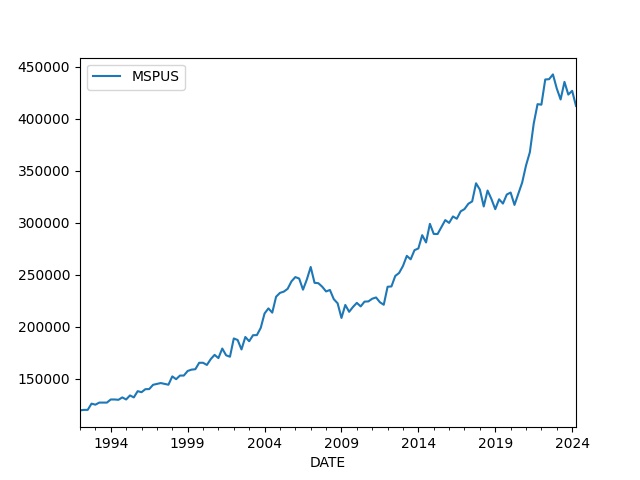

Real Estate

Median house prices

df = u.get_fred(1992,"MSPUS")

df.plot()

print (df.tail(3))

plt.savefig('medhouse.jpg')

MSPUS

DATE

2024-10-01 419300

2025-01-01 423100

2025-04-01 410800

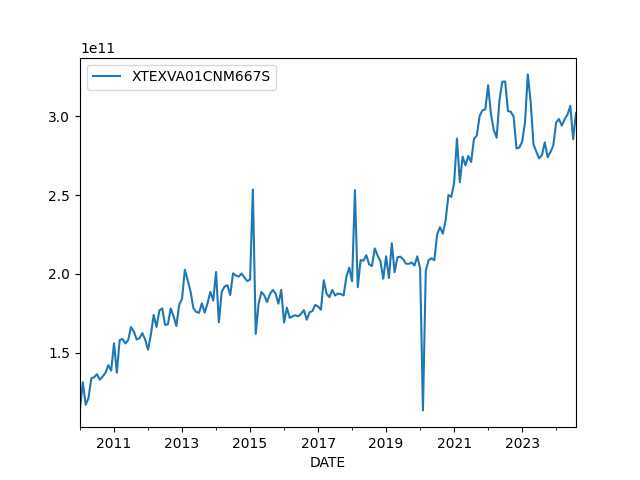

Foreign

Chinese Exports

df = u.get_fred(2010,['XTEXVA01CNM667S']); df.plot()

plt.savefig('exchina.jpg')

print (df.tail(5))

XTEXVA01CNM667S

DATE

2025-01-01 3.082494e+11

2025-02-01 2.923886e+11

2025-03-01 3.271552e+11

2025-04-01 3.189337e+11

2025-05-01 3.159533e+11

References, Notes

[1] Note: for Quandl retrieval get the API key from Quandl, and place the

key in a .quandl file in the same directory as this file.

[2] Komlos

[3] Mathworks

[5] Hedgeeye

[6] Schiller